Navigate Your Online Income Tax Return in Australia: Essential Resources and Tips

Browsing the on the internet tax obligation return process in Australia requires a clear understanding of your commitments and the sources offered to improve the experience. Vital files, such as your Tax Obligation Data Number and revenue statements, must be thoroughly prepared. Selecting an ideal online platform can substantially impact the effectiveness of your filing process.

Recognizing Tax Commitments

Individuals need to report their earnings precisely, which consists of earnings, rental income, and financial investment earnings, and pay taxes as necessary. Residents should comprehend the difference between taxable and non-taxable revenue to ensure conformity and maximize tax obligation results.

For businesses, tax obligation responsibilities include multiple facets, consisting of the Goods and Provider Tax (GST), firm tax obligation, and payroll tax obligation. It is vital for services to register for an Australian Organization Number (ABN) and, if suitable, GST registration. These responsibilities require precise record-keeping and prompt submissions of tax returns.

In addition, taxpayers ought to know with offered deductions and offsets that can ease their tax worry. Inquiring from tax obligation professionals can supply important understandings into optimizing tax placements while making certain compliance with the regulation. Overall, a thorough understanding of tax responsibilities is vital for efficient economic planning and to prevent fines related to non-compliance in Australia.

Crucial Files to Prepare

Furthermore, assemble any type of pertinent bank statements that show rate of interest earnings, along with reward declarations if you hold shares. If you have various other resources of revenue, such as rental residential or commercial properties or freelance work, ensure you have records of these profits and any type of connected costs.

Don't fail to remember to include deductions for which you may be eligible. This might involve invoices for occupational expenditures, education and learning prices, or philanthropic donations. Take into consideration any kind of exclusive wellness insurance coverage statements, as these can affect your tax obligations. By collecting these essential records beforehand, you will streamline your on-line tax obligation return process, minimize errors, and make the most of potential reimbursements.

Choosing the Right Online System

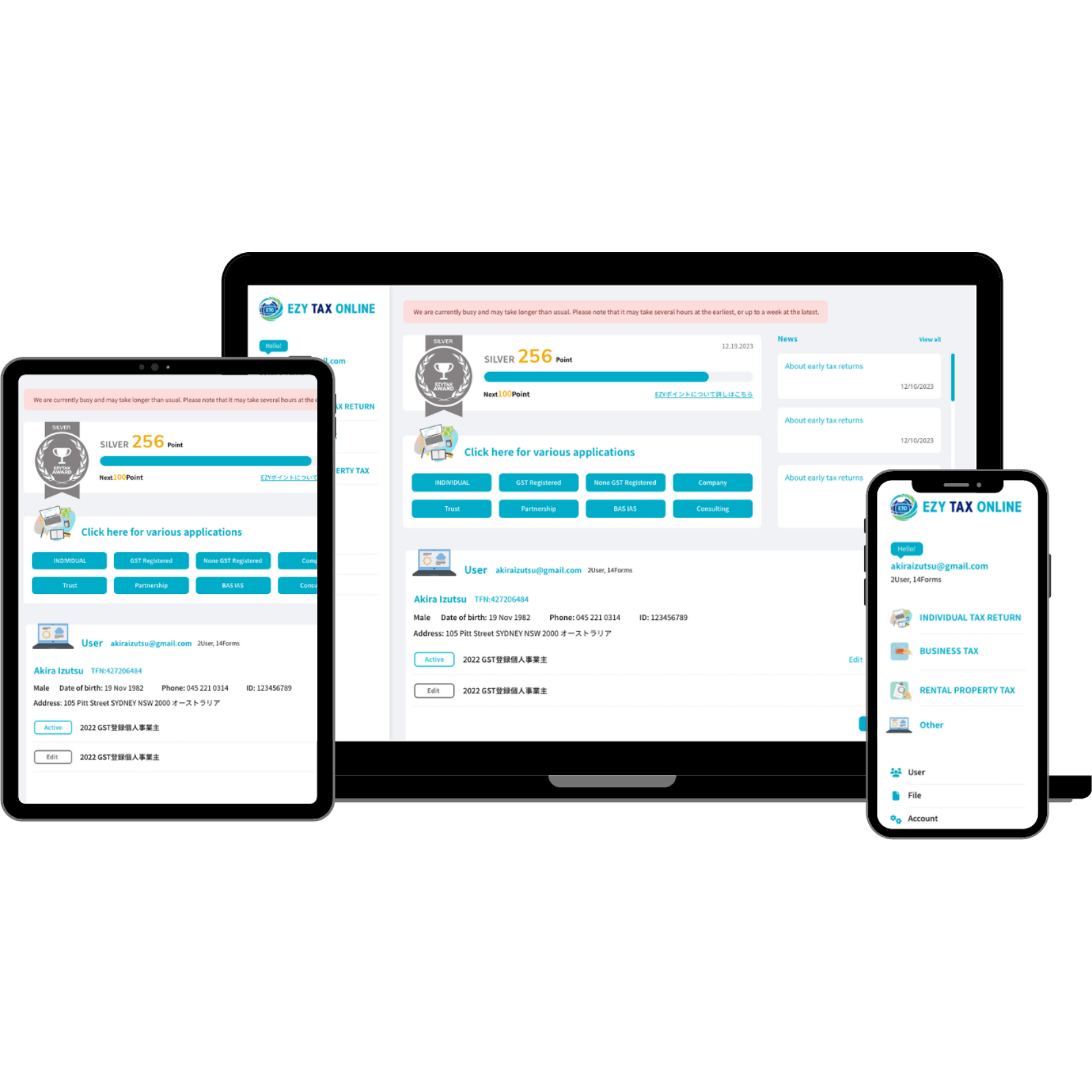

As you prepare to submit your online tax return in Australia, choosing the appropriate platform is vital to make certain accuracy and ease of use. A simple, instinctive design can considerably improve your experience, making it less complicated to browse complex tax types.

Next, examine the system's compatibility with your economic scenario. Some solutions provide especially to people with simple income tax return, while others offer extensive assistance for a lot more intricate circumstances, such as self-employment or financial investment earnings. In addition, search for platforms that supply real-time error monitoring and guidance, helping to minimize mistakes and ensuring compliance with Australian tax obligation regulations.

One more essential aspect to consider is the degree of consumer support available. Reputable platforms should give accessibility to help through conversation, phone, or email, especially throughout top filing durations. Furthermore, research customer evaluations and ratings to determine the general fulfillment and reliability of the system.

Tips for a Smooth Filing Process

Submitting your on-line tax return can be a simple procedure if you follow a few crucial tips to guarantee performance and precision. This includes your income statements, invoices for reductions, and any kind of other relevant documents.

Following, take benefit of the pre-filling feature offered by numerous on the internet systems. This can conserve time and reduce the chance of mistakes by immediately occupying your return with address details from previous years and information given by your employer and financial institutions.

Furthermore, confirm all entrances for precision. online tax return in Australia. Errors can bring about postponed reimbursements or concerns with the Australian Tax Workplace (ATO) straight from the source Make certain that your individual information, earnings numbers, and deductions are right

Be conscious of due dates. If you owe tax obligations, filing early not just lowers stress and anxiety yet additionally permits for much better planning. If you have uncertainties or questions, consult the aid sections of your chosen system or seek professional suggestions. By complying with these suggestions, you can browse the on the internet income tax return process smoothly and with confidence.

Resources for Help and Support

Browsing the complexities of on-line income tax return can occasionally be overwhelming, however a selection of resources for aid and support are conveniently available to assist taxpayers. The Australian Taxation Office (ATO) is the key source of info, offering detailed overviews on its site, consisting of FAQs, training video clips, and live chat choices for real-time aid.

Furthermore, the ATO's phone assistance line is available for those who choose direct interaction. online tax return in Australia. Tax experts, such as registered tax representatives, can additionally provide individualized guidance and guarantee conformity with existing tax obligation policies

Verdict

Finally, effectively navigating the online tax return process in Australia requires a complete understanding of tax obligation commitments, careful prep work of crucial documents, and careful option of an appropriate online system. Following sensible pointers can boost the declaring experience, while offered resources provide important assistance. By approaching the procedure with persistance and interest to detail, taxpayers can ensure conformity and maximize possible advantages, eventually adding to a more efficient and effective income tax return end result.

As you prepare to file your on-line tax return in Australia, picking the best system is vital to ensure precision and ease of use.In verdict, successfully navigating the on the internet tax obligation return process in Australia calls check it out for an extensive understanding of tax obligation responsibilities, thorough preparation of crucial files, and cautious option of a suitable online system.

Comments on “Recognizing the Process Behind an Online Tax Return in Australia and How It Functions”